Callbacks

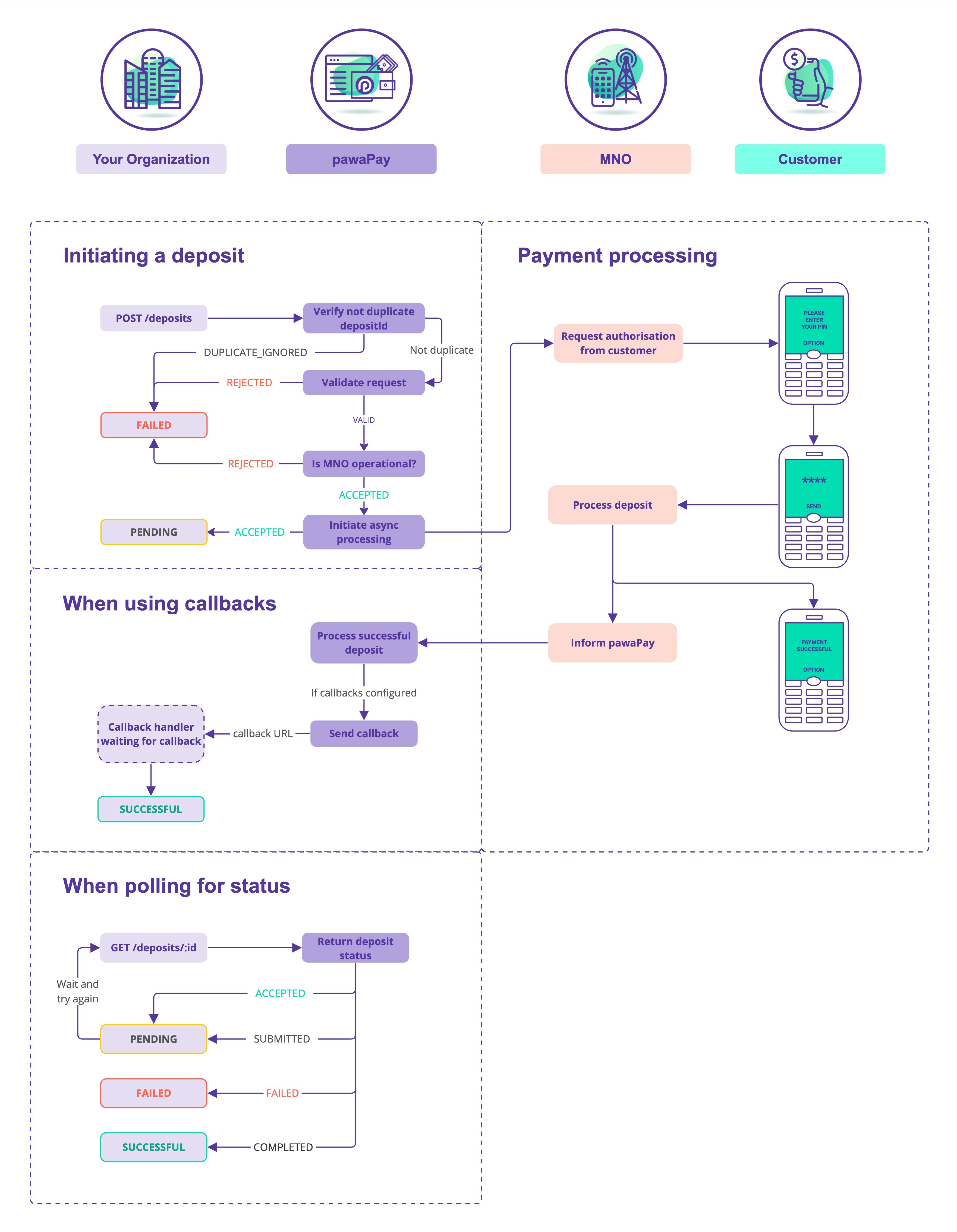

The pawaPay Merchant API is asynchronous. This is necessary to provide high performance and quality payment infrastructure that is able to process millions of payments every day. When you call any financial endpoint (payout, deposit, refund), the response will confirm whether the transaction is accepted or rejected for processing. A transaction may be rejected due to reasons such as using the same ID more than once or the provider being unavailable at the moment. If the response confirms that the payment has been accepted for processing, it will take some time for it to process (remember that for deposits, the user needs to enter their PIN on their phone). There are two ways to determine the final status of a payment.Polling for status

First, you can use the correspondingCheck Status endpoint for the transaction type to periodically check the status of a payment.

Through callbacks

Second, you can configure callback URLs in the pawaPay Dashboard. This will automatically send a callback to your configured callback URL as soon as a payment has reached its final status. You will have to implement a callback handler that is able to receive calls from our platform and handle them accordingly.

Setting up callbacks

Callback URLs are configured from the pawaPay Dashboard. You can find instructions on how to do that from the pawaPay Dashboard Docs.Handling callbacks

When implementing your callback handler, please consider the following points.- Your endpoint for receiving callbacks must be idempotent.

- Sending a callback more than once for the same payment should not cause a double credit or debit in your system.

- Your endpoint needs to allow us to

POSTthe callback. - Make sure you use an SSL certificate from a trusted CA.

- We will attempt to deliver callbacks for 15 minutes.

- We expect you to return

HTTP 200 OKresponse to consider the callback delivered. - If the callback delivery fails, you can always trigger a resend of the callback. This can be done by:

- Calling the respective

Resend callbackendpoint - Manually from the pawaPay Dashboard.

- Calling the respective

- The endpoint should be accessible to our platform.

- Ensure that you have excluded the callback endpoint from your application’s regular authentication system.

- If you are using IP whitelisting, whitelist the below IPs to ensure we can deliver callbacks to you.

IPs to whitelist

Callbacks from pawaPay will be coming from one of the IPs listed below.| Environment | IP |

|---|---|

| Sandbox | 3.64.89.224/32 |

| Production | 18.192.208.15/32 |

| Production | 18.195.113.136/32 |

| Production | 3.72.212.107/32 |

| Production | 54.73.125.42/32 |

| Production | 54.155.38.214/32 |

| Production | 54.73.130.113/32 |

MMO stability

As described in the What’s mobile money section, mobile money transaction chains are complex. This means that the stability of payment services needs to be taken into account when implementing a high-quality payment flow. pawaPay provides multiple solutions to make this easy to manage. Our 24/7 payment operations team monitors all MMOs on our platform for instability and downtime. We stop accepting payments to those MMOs if the success rate is too low. This information is accessible from our provider availability endpoint. You can verify before initiating the payment if the MMO is currently experiencing any problems and inform the user before they attempt the payment. Knowing that your mobile money provider is currently unavailable is a better customer experience than having your payment fail. Failed payments usually take longer to process, leaving the customer waiting for the final result. To provide the best support for your customers, information about MMO availability is also published in the pawaPay Dashboard and Status page. You can subscribe to updates via email, Slack and other channels to ensure your support team is always informed about any potential problems with the MMOs. When an MMO is experiencing difficulties in successfully processing disbursements, our platform will enqueue them to be processed once the MMO is operational. Read more about enqueued payouts. Occasionally, MMOs experience degraded system performance, which can prevent their APIs from returning the final status of payments. During these periods, our platform continues to accept and process payments. We reconcile these transactions through alternative methods using our reconciliation engine. This ensures that, when using pawaPay, all payments are eventually reconciled to their final status. Please note that this process may take slightly longer than during normal operations.Transaction limits

Mobile money wallets have different limits for transactions. Most common and relevant are:- Maximum amount of deposits/payouts in a day/week/month.

- Maximum number of deposits/payouts in a day/week/month.

- Maximum balance of a mobile money wallet.

For example, an MMO has a 1,000 GHS maximum deposit amount. In reality the wallet has a limitation of 1,000 GHS total transaction value per day/week/month. If the user has already transacted 500 GHS during this period, a transaction of 700 GHS might still fail even though it is accepted by pawaPay.You can easily find the transaction limits from our active configuration endpoint.