What you should know

Understand some considerations to take into account when working with mobile money.

How to start

Sort out API tokens and callbacks.

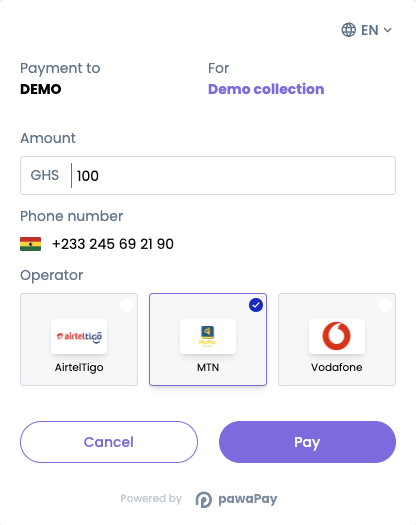

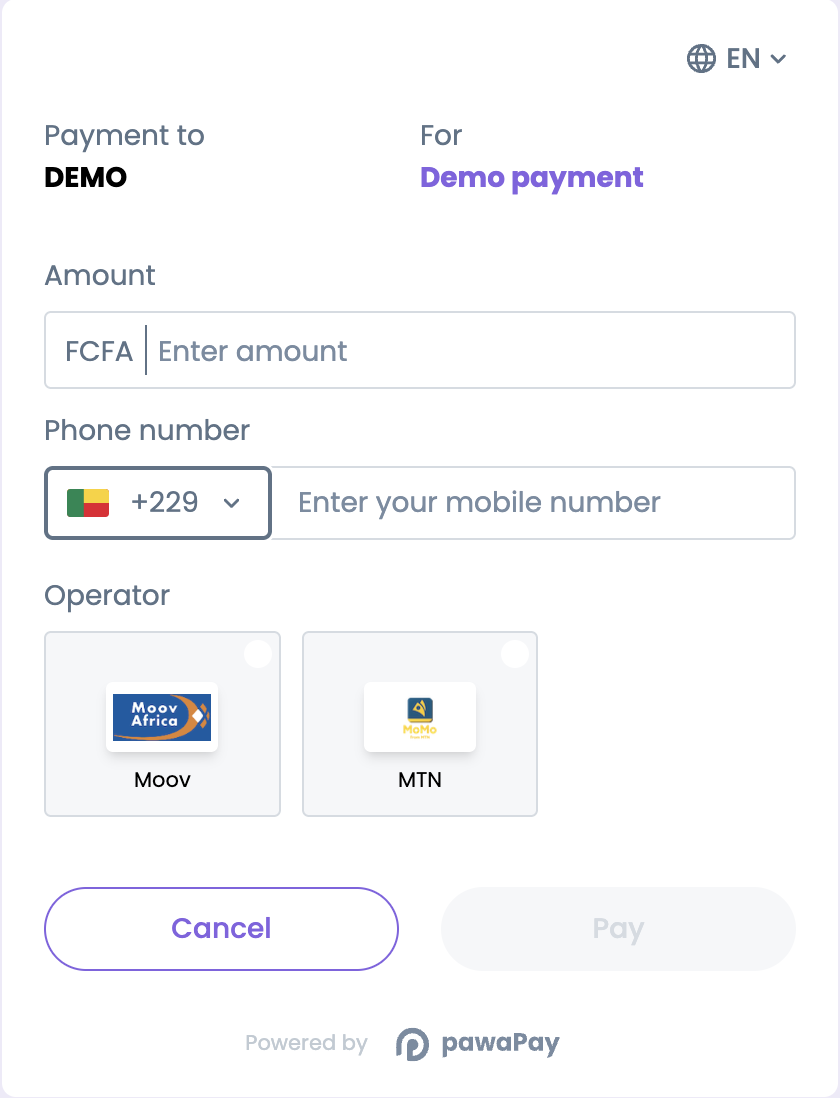

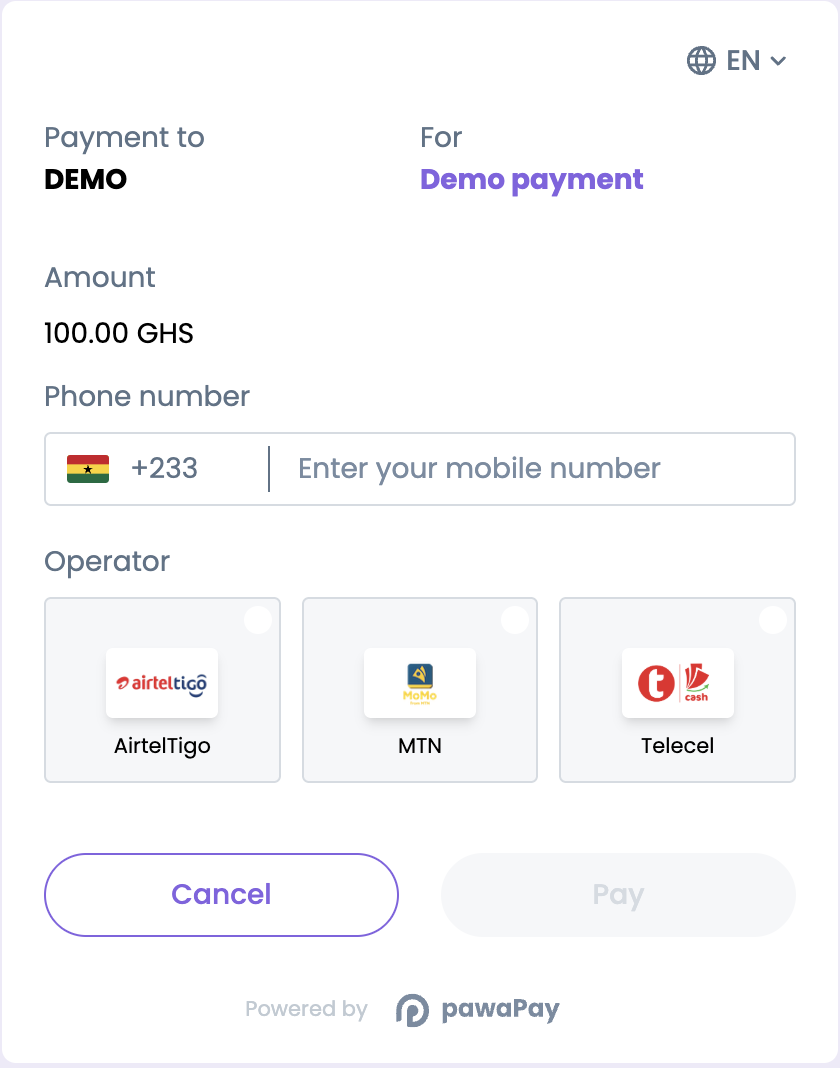

What does it look like

The pawaPay Payment Page allows you to quickly integrate mobile money into your website or mobile app providing:- A user experience for your customers that is optimised for mobile money.

- Responsive design that works on desktop and mobile.

- Low code integration supporting all countries and providers.

- Support for both e-commerce and e-wallet use cases.

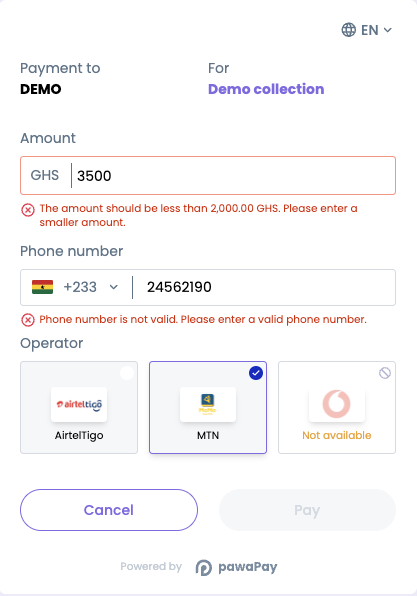

- Phone numbers are validated to be in the correct format.

- The provider to use for the payment is predicted based on the entered phone number.

- Minimum and maximum transaction limits are always up to date and validated.

- When new countries or providers are enabled, they are available for your customers immediately.

- Information about provider downtime is integrated into the user experience.

- And many more improvements to come…

How to use it

Let’s take a look at a couple of different use cases for the Payment page. Then we will also see how to handle payment results.Payment page for all countries

The payment page can support accepting a payment from any country in any amount below the transaction limits for the provider.We do that using the Deposit via payment page endpoint.We ask you to generate a UUIDv4

depositId to uniquely identify the deposit that will be processed using the payment page.

This is so that you always have a reference to the deposit you are expecting, even if you do not receive a response from us due to network errors.

This allows you to always reconcile all payments between your system and pawaPay.

You should store this depositId in your system before initiating the deposit with pawaPay.The returnUrl specifies where the customer should be redirected to after they have gone through the payment process.The reason field is optional. It will be shown on the payment page to the customer to indicate what they are paying for.The payment page allows them to choose the country from the dropdown.

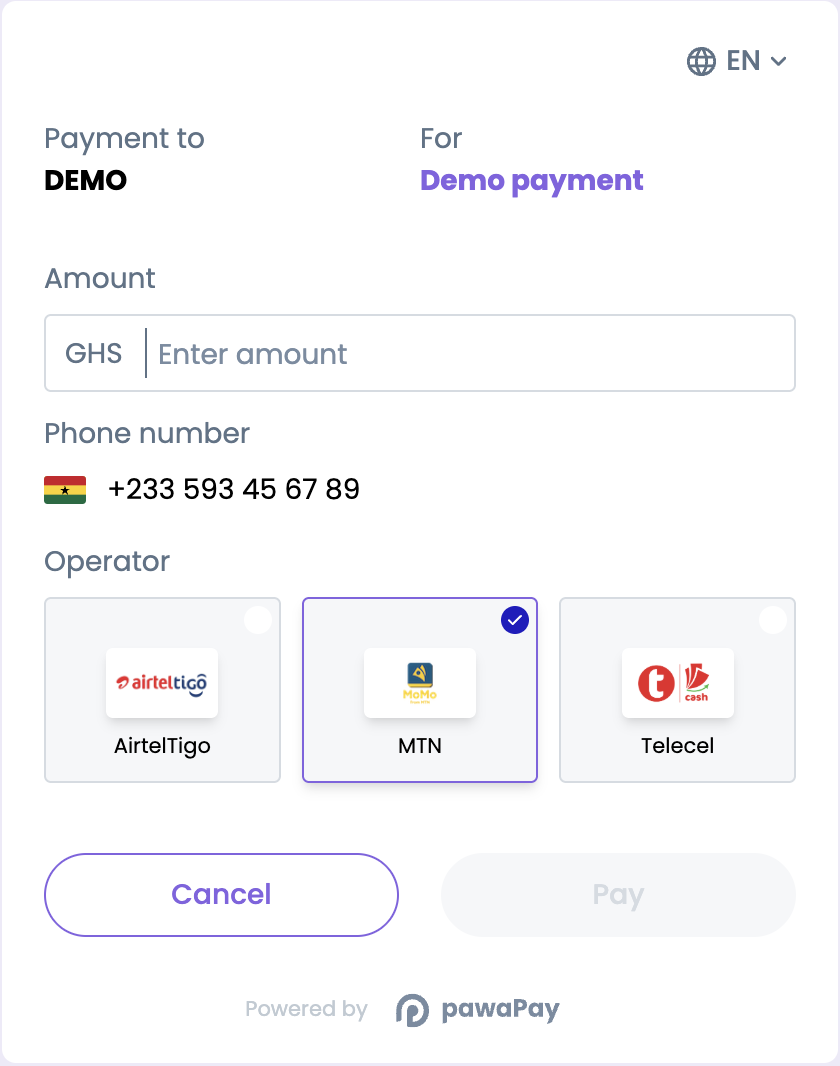

Payment page with fixed phone number

If you have registered users who should only use the number that they signed up with for payments, you can fix the phone number on the payment page.The

msisdn fixes the mobile money wallet that can be used for this payment.The payment page only allows them to choose the amount to pay.

Payment page with fixed amount

In case you know how much the customer should be paying, but they can choose the mobile money wallet they want to pay from, you can fix the amount as well.The

amount specifies the amount that can be used for this payment.The payment page will allow the customer to specify the phone number of the mobile money wallet they are paying from.

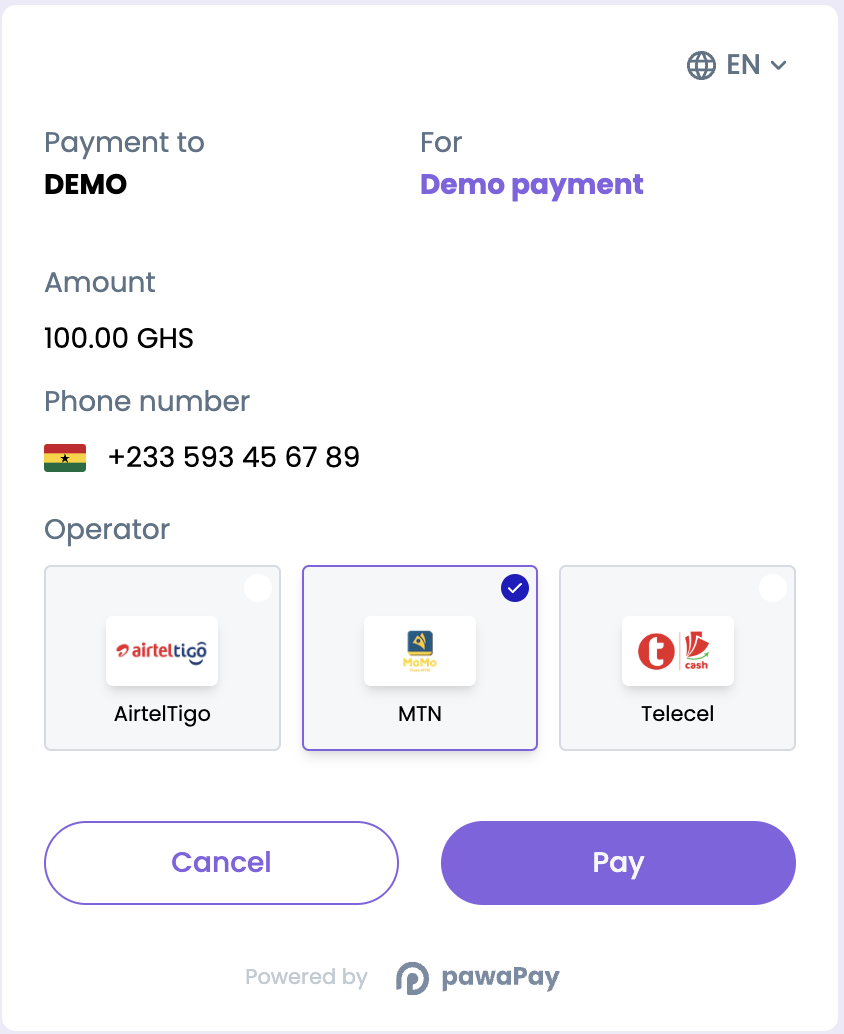

Get a payment page with fixed amount and phone number

When you have only registered users and the amount is predetermined, you can initiate the payment page to fix those parameters so the customers cannot change them.We do that using the Deposit via payment page endpoint.In the request we have specified the

msisdn (phone number) that must be used for the payment.

We have also fixed the amount to 100 so it cannot be changed by the customer.

We then need to take the customer to the payment page

In the response you will receive the You should redirect the customer to the

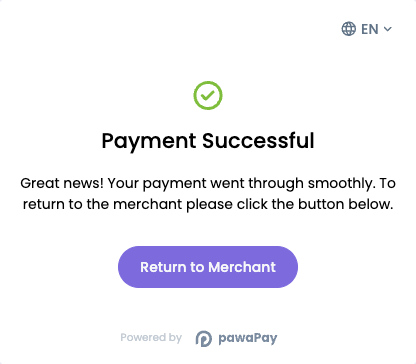

redirectUrl.redirectUrl.Once they have completed the payment process, they will be redirected to the returnUrl you provided in the request.How to find out the payment result

How do I find out if the payment was completed?

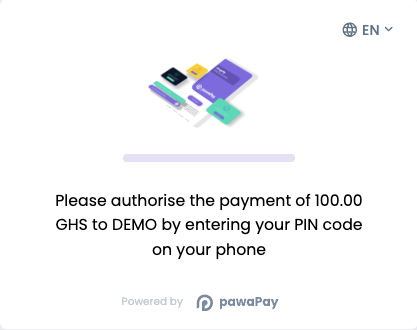

When the customer initiates the payment by pressing “Pay” on the payment page, the deposit will be registered in pawaPay with the

depositId you specified.When the payment completes you will receive a deposit callback with the final status of the payment.If you have not configured callbacks, you can poll the check deposit status endpoint.On your returnUrl you should validate the final status of the payment by either confirming the callback has been received or using the check deposit status endpoint.Handling processing failures

Handling failures during processing

If the

status of the deposit is FAILED you can find further information about the failure from failureReason.

It includes the failureCode and the failureMessage indicating what has gone wrong.Find all the failure codes and implement handling as you choose.We recommend showing the customer the failure reason and an easy way to retry the payment in case of failure.

A new payment page needs to be created with a new depositId for the retry.Ensuring consistency

When working with financial APIs there are some considerations to take to ensure that you never think a payment is failed, when it is actually successful or vice versa. It is essential to keep systems in sync on the statuses of payments. Let’s take a look at some considerations and pseudocode to ensure consistency.Handling network errors and system crashes

The key reason we require you to provide a The important thing to notice here is that we only mark a payment as FAILED when there is a clear indication of its failure.

We use the check deposit status endpoint when in doubt whether the payment was

depositId for each payment is to ensure that you can always ask us what the status of a payment is, even if you never get a response from us.You should always store this depositId in your system before initiating a deposit.ACCEPTED by pawaPay.Implementing an automated reconciliation cycle

Implementing the considerations listed above avoids almost all discrepancies of payment statuses between your system and pawaPay.

When using callbacks to receive the final statuses of payments, issues like network connectivity, system downtime, and configuration errors might cause the callback not to be received by your system.

To avoid keeping your customers waiting, we strongly recommend implementing a status recheck cycle.This might look something like the following.Having followed the rest of the guide, with this simple reconciliation cycle, you should not have any inconsistencies between your system and pawaPay.

Having these checks automated will take a load off your operations and support teams as well.

Payments in reconciliation

When using pawaPay, you might find that a payment status isIN_RECONCILIATION.

This means that there was a problem determining the correct final status of a payment.

When using pawaPay all payments are reconciled by default and automatically - we validate all final statuses to ensure there are no discrepancies.

When encountering payments that are IN_RECONCILIATION you do not need to take any action.

The payment has already been sent to our automatic reconciliation engine and it’s final status will be determined soon.

The reconciliation time varies by provider. Payments that turn out to be successful are reconciled faster.

What to do next?

We’ve made everything easy to test in our sandbox environment before going live.Test different failure scenarios

We have different phone numbers that you can use to test various failure scenarios on your sandbox account.

Review failure codes

Make sure all the failure codes are handled.

Add another layer of security

To ensure your funds are safe even if your API token should leak, you can always implement signatures for financial calls to add another layer of security.

And when you are ready to go live

Have a look at what to consider to make sure everything goes well.